India’s SUV boom is not merely about ground clearance or body styles; it is also about psychology.

For decades, India’s passenger vehicle hierarchy followed a predictable script. Maruti Suzuki dominated the mass market with scale and reliability. Hyundai sat securely in second place, balancing design flair with efficiency. Homegrown brands—primarily Mahindra & Mahindra and Tata Motors—operated on the fringes, strong in utility vehicles and entry segments but rarely central to aspiration. SUVs (sport utility vehicles) existed, but they were either rugged workhorses or niche lifestyle machines.

By 2025, that script had been decisively torn up. The Indian SUV market is no longer just a fast-growing segment; it has become the centre of gravity for the entire auto industry—driving volumes, margins, brand narratives, and emotional aspiration. Utility vehicles, SUVs and MPVs ((multi-purpose vehicles) accounted for 66% of India’s passenger vehicle market in calendar year 2025, up from 61.2% in 2024, according to SIAM (Society of Indian Automobile Manufacturers).

At the heart of this transformation lies a defining story: the rise of homegrown brands, led by Mahindra & Mahindra and Tata Motors. Not only have they challenged global carmakers, but they have also fundamentally changed how vehicles are designed, launched, marketed, and emotionally positioned in India.

The SUV as a Psychological Upgrade

India’s SUV boom is not merely about ground clearance or body styles. It is about psychology. Today’s buyer seeks presence, safety, digital sophistication, and a sense of personal expression. Large touchscreens, connected features, over-the-air updates, and bold design cues matter as much as ride quality or fuel efficiency. The vehicle is no longer just transportation; it is an extension of identity.

This shift has favoured brands that understand Indian conditions intuitively and can translate that insight into products that feel confident rather than compromised. As Avik Chattopadhyay, founder of brand consulting firm Expereal, puts it, the current success of Tata and Mahindra is not just ‘product-led’, but more importantly, it is ‘psychographic-led’.

“Brands today are catering to specific mindsets, not just price bands,” Chattopadhyay notes. Mahindra’s bold, almost confrontational design language connects strongly with buyers between 25 and 40— urban, upwardly mobile consumers who want their cars to make a statement. Tata Motors, by contrast, appeals to a broader, more harmonised sensibility—modern and responsible rather than overtly aggressive.

“Brands today are catering to specific mindsets, not just price bands,” Chattopadhyay notes. Mahindra’s bold, almost confrontational design language connects strongly with buyers between 25 and 40— urban, upwardly mobile consumers who want their cars to make a statement. Tata Motors, by contrast, appeals to a broader, more harmonised sensibility—modern and responsible rather than overtly aggressive.

This divergence is not accidental. It reflects a deeper segmentation of India’s car market, where emotional resonance increasingly trumps mechanical parity.

CY’25: When the Balance of Power Shifted

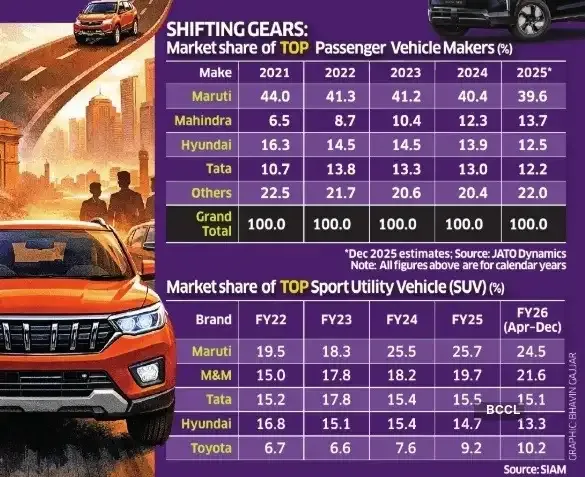

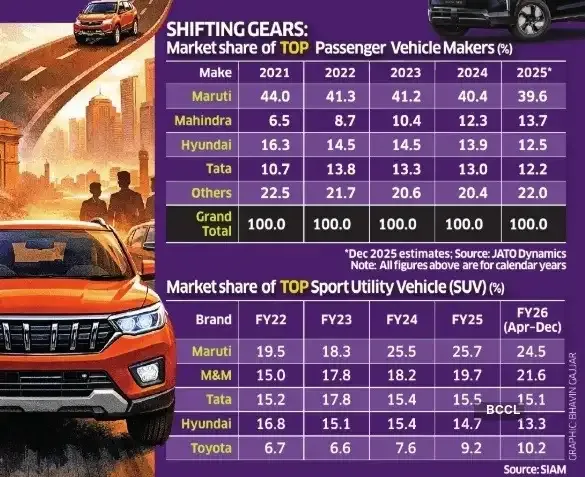

Calendar year 2025 marked a clear inflection point. Mahindra & Mahindra emerged as the biggest beneficiary of the SUV wave, selling 5.93 lakh vehicles, up from 4.93 lakh in 2024, according to the Federation of Automobile Dealers Associations (FADA). Its market share jumped to 13.25% from 12.08%, propelling it from fourth place to second position in the passenger vehicle rankings.

Tata Motors followed closely, growing volumes to 5.68 lakh units from 5.38 lakh units. While its market share dipped marginally, Tata retained enormous relevance—particularly as India’s undisputed leader in electric passenger vehicles.

The real shock came from Hyundai Motor India. Volumes stagnated at around 5.60 lakh units, marginally lower than the previous year, resulting in market share erosion to 12.50% from 13.76%. For the first time in over two decades, Hyundai slipped to fourth place. Even Maruti Suzuki, the market leader, was not immune. Though volumes rose to 17.86 lakh units from 16.42 lakh units, market share edged down to 39.91% from 40.24%, highlighting that rivals were growing faster in higher-value SUV segments.

Toyota Kirloskar Motor stood out as the exception among global players, growing volumes to 3.21 lakh units from 2.61 lakh units. Its performance reinforced an enduring truth about India: execution, reliability, and after-sales trust still matter deeply.

Underscoring the growing competitive intensity the UV market shares (refer to the chart) are shifting steadily rather than remaining concentrated. While Maruti is the UV market leader and M&M has gained share over time, Tata and Hyundai have seen relative stagnation, and Toyota’s gradual increase indicates growing pressure across the mid and lower tiers.

Mahindra: Reinvention at Scale

Mahindra’s ascent was not the result of a single blockbuster. It was a multi-year, tightly sequenced strategy that began around 2021 and compounded steadily.

“What worked for us in 2025 was that everything came together,” said Rajesh Jejurikar, CEO (chief executive officer) of Auto and Farm Sectors, Mahindra & Mahindra. “We got the full benefit of new launches, refreshes, and strong core brands continuing to perform.”

Products like the Thar, Scorpio-N, and XUV700 did more than succeed commercially—they redefined their segments. Even legacy models like the Bolero benefited from timely, minor updates that reignited customer interest. From a branding standpoint, Mahindra’s transformation runs deeper than products alone. As Chattopadhyaya observes, the company undertook a holistic identity overhaul—new logo, new brand language, and a new design confidence. “Even if the logo hadn’t changed, the products would have done the trick,” he says. “But together, it signalled a larger journey.” Mahindra’s design today is unapologetically bold, ‘in your face,’ as Chattopadhyaya describes it. That boldness resonates strongly with a generation that values differentiation over conformity, even if it means tolerating imperfect service experiences.

Marketing as Momentum, Not a Moment

Equally transformative has been Mahindra’s approach to marketing. Traditional one-day launches have been replaced by digital-first, always-on campaigns— teasers, influencer engagement, phased reveals, and sustained online conversation.

Naming strategies have reinforced this shift. The decision to introduce sub-brands like the XUV 7XO signalled meaningful technological change rather than cosmetic updates. “It had to feel like a significant upgrade,” Jejurikar explains. This continuous buzz cycle has kept Mahindra top-of-mind in an increasingly crowded SUV market.

Tata Motors: Powering Aspiration

Tata Motors’ resurgence has followed a different, but equally strategic, path. Where Mahindra thrives on performance and attitude, Tata focuses on democratising aspiration—making SUVs and EVs (electric vehicles) accessible without diluting safety or substance.

“2025 was a year of intense launches for us,” says Shailesh Chandra, MD & CEO of Tata Motors Passenger Vehicles and Tata Passenger Electric Mobility. “Post-GST (goods and service tax) disruptions, the second half really turned the momentum.” The Punch exemplifies Tata’s philosophy. Positioned as a micro-SUV, it created a new segment by offering SUV-like confidence at hatchback prices—while becoming the first five-starrated car in its category.

Tata’s EV leadership is even more significant. With over 2.5 lakh cumulative EV sales and the Nexon EV crossing one lakh units, Tata has normalised electric mobility for Indian buyers. Larger EVs like the Harrier EV indicate a move up the value chain.

Yet, as Chattopadhyaya points out, Tata’s challenge lies in brand sharpness. Its design language is modern and harmonious, but lacks the aggressive edge that currently excites younger buyers. The upcoming Sierra could inject freshness, but it may not be enough to redefine the entire portfolio.

EVs, Motorsport, and the New Slugfest

The Mahindra–Tata rivalry has moved beyond engines and mileage into electric platforms, software-defined vehicles, and motorsport credibility. Mahindra’s Formula E involvement and Tata’s global racing exposure are no longer symbolic—they feed directly into product storytelling. Emotion matters more than ever in EVs, where rational arguments alone rarely close the sale.

The numbers validate this strategy. Mahindra’s XEV 9e sold 27,700 units within months, becoming 2025’s second-best-selling EV. Tata’s Harrier EV crossed 15,000 units in six months. These are mainstream volumes, not experiments.

What Still Holds Them Back

Despite the momentum, challenges remain. Aftersales service continues to be a weak spot for both Tata and Mahindra. Online forums are filled with inconsistent ownership experiences, and multinational benchmarks—particularly Toyota’s— remain daunting. Yet, Chattopadhyaya notes that the current buyer cohort is more forgiving. These are consumers who might also choose Volkswagen or Citroën—brands known more for personality than flawless service. Expression, not perfection, is the trade-off.

Maruti and Hyundai: In Transition

According to Ravi Bhatia, President and Director at JATO Dynamics, the rise of Tata and Mahindra does not signal the fall of Maruti and Hyundai—it signals a transition. Maruti and Hyundai still dominate reliability, cost efficiency, service reach, and resale value. Maruti’s 4,500-plus service touchpoints and Hyundai’s strong used-car performance remain formidable strengths.

However, as buyers increasingly ‘trade up', aspiration and emotional differentiation matter more. Tata and Mahindra have adapted faster to this new definition of value. “The real story is not winners versus losers,” Bhatia argues. “It’s about who adapted fastest.”

Beyond 2025: The Road Ahead

The excitement shows no signs of fading. Mahindra began 2026 with 90,000 bookings for the XUV 7XO and XEV 9S, worth ₹20,500 crore. Tata Motors received 70,000 day-one bookings for the Sierra. Cancellations will occur, but the signal is unmistakable: Indian buyers are emotionally invested. India’s SUV market is no longer following global trends—it is defining its own. The true test now lies in sustainability: quality, service, and long-term trust. The race has changed lanes. And for the first time, India’s homegrown brands are setting the pace, not chasing it.

By 2025, that script had been decisively torn up. The Indian SUV market is no longer just a fast-growing segment; it has become the centre of gravity for the entire auto industry—driving volumes, margins, brand narratives, and emotional aspiration. Utility vehicles, SUVs and MPVs ((multi-purpose vehicles) accounted for 66% of India’s passenger vehicle market in calendar year 2025, up from 61.2% in 2024, according to SIAM (Society of Indian Automobile Manufacturers).

At the heart of this transformation lies a defining story: the rise of homegrown brands, led by Mahindra & Mahindra and Tata Motors. Not only have they challenged global carmakers, but they have also fundamentally changed how vehicles are designed, launched, marketed, and emotionally positioned in India.

The SUV as a Psychological Upgrade

India’s SUV boom is not merely about ground clearance or body styles. It is about psychology. Today’s buyer seeks presence, safety, digital sophistication, and a sense of personal expression. Large touchscreens, connected features, over-the-air updates, and bold design cues matter as much as ride quality or fuel efficiency. The vehicle is no longer just transportation; it is an extension of identity.

This shift has favoured brands that understand Indian conditions intuitively and can translate that insight into products that feel confident rather than compromised. As Avik Chattopadhyay, founder of brand consulting firm Expereal, puts it, the current success of Tata and Mahindra is not just ‘product-led’, but more importantly, it is ‘psychographic-led’.

This divergence is not accidental. It reflects a deeper segmentation of India’s car market, where emotional resonance increasingly trumps mechanical parity.

CY’25: When the Balance of Power Shifted

Calendar year 2025 marked a clear inflection point. Mahindra & Mahindra emerged as the biggest beneficiary of the SUV wave, selling 5.93 lakh vehicles, up from 4.93 lakh in 2024, according to the Federation of Automobile Dealers Associations (FADA). Its market share jumped to 13.25% from 12.08%, propelling it from fourth place to second position in the passenger vehicle rankings.

Tata Motors followed closely, growing volumes to 5.68 lakh units from 5.38 lakh units. While its market share dipped marginally, Tata retained enormous relevance—particularly as India’s undisputed leader in electric passenger vehicles.

The real shock came from Hyundai Motor India. Volumes stagnated at around 5.60 lakh units, marginally lower than the previous year, resulting in market share erosion to 12.50% from 13.76%. For the first time in over two decades, Hyundai slipped to fourth place. Even Maruti Suzuki, the market leader, was not immune. Though volumes rose to 17.86 lakh units from 16.42 lakh units, market share edged down to 39.91% from 40.24%, highlighting that rivals were growing faster in higher-value SUV segments.

Toyota Kirloskar Motor stood out as the exception among global players, growing volumes to 3.21 lakh units from 2.61 lakh units. Its performance reinforced an enduring truth about India: execution, reliability, and after-sales trust still matter deeply.

Underscoring the growing competitive intensity the UV market shares (refer to the chart) are shifting steadily rather than remaining concentrated. While Maruti is the UV market leader and M&M has gained share over time, Tata and Hyundai have seen relative stagnation, and Toyota’s gradual increase indicates growing pressure across the mid and lower tiers.

Mahindra: Reinvention at Scale

Mahindra’s ascent was not the result of a single blockbuster. It was a multi-year, tightly sequenced strategy that began around 2021 and compounded steadily.

“What worked for us in 2025 was that everything came together,” said Rajesh Jejurikar, CEO (chief executive officer) of Auto and Farm Sectors, Mahindra & Mahindra. “We got the full benefit of new launches, refreshes, and strong core brands continuing to perform.”

Products like the Thar, Scorpio-N, and XUV700 did more than succeed commercially—they redefined their segments. Even legacy models like the Bolero benefited from timely, minor updates that reignited customer interest. From a branding standpoint, Mahindra’s transformation runs deeper than products alone. As Chattopadhyaya observes, the company undertook a holistic identity overhaul—new logo, new brand language, and a new design confidence. “Even if the logo hadn’t changed, the products would have done the trick,” he says. “But together, it signalled a larger journey.” Mahindra’s design today is unapologetically bold, ‘in your face,’ as Chattopadhyaya describes it. That boldness resonates strongly with a generation that values differentiation over conformity, even if it means tolerating imperfect service experiences.

Marketing as Momentum, Not a Moment

Equally transformative has been Mahindra’s approach to marketing. Traditional one-day launches have been replaced by digital-first, always-on campaigns— teasers, influencer engagement, phased reveals, and sustained online conversation.

Naming strategies have reinforced this shift. The decision to introduce sub-brands like the XUV 7XO signalled meaningful technological change rather than cosmetic updates. “It had to feel like a significant upgrade,” Jejurikar explains. This continuous buzz cycle has kept Mahindra top-of-mind in an increasingly crowded SUV market.

Tata Motors: Powering Aspiration

Tata Motors’ resurgence has followed a different, but equally strategic, path. Where Mahindra thrives on performance and attitude, Tata focuses on democratising aspiration—making SUVs and EVs (electric vehicles) accessible without diluting safety or substance.

“2025 was a year of intense launches for us,” says Shailesh Chandra, MD & CEO of Tata Motors Passenger Vehicles and Tata Passenger Electric Mobility. “Post-GST (goods and service tax) disruptions, the second half really turned the momentum.” The Punch exemplifies Tata’s philosophy. Positioned as a micro-SUV, it created a new segment by offering SUV-like confidence at hatchback prices—while becoming the first five-starrated car in its category.

Tata’s EV leadership is even more significant. With over 2.5 lakh cumulative EV sales and the Nexon EV crossing one lakh units, Tata has normalised electric mobility for Indian buyers. Larger EVs like the Harrier EV indicate a move up the value chain.

Yet, as Chattopadhyaya points out, Tata’s challenge lies in brand sharpness. Its design language is modern and harmonious, but lacks the aggressive edge that currently excites younger buyers. The upcoming Sierra could inject freshness, but it may not be enough to redefine the entire portfolio.

EVs, Motorsport, and the New Slugfest

The Mahindra–Tata rivalry has moved beyond engines and mileage into electric platforms, software-defined vehicles, and motorsport credibility. Mahindra’s Formula E involvement and Tata’s global racing exposure are no longer symbolic—they feed directly into product storytelling. Emotion matters more than ever in EVs, where rational arguments alone rarely close the sale.

The numbers validate this strategy. Mahindra’s XEV 9e sold 27,700 units within months, becoming 2025’s second-best-selling EV. Tata’s Harrier EV crossed 15,000 units in six months. These are mainstream volumes, not experiments.

What Still Holds Them Back

Despite the momentum, challenges remain. Aftersales service continues to be a weak spot for both Tata and Mahindra. Online forums are filled with inconsistent ownership experiences, and multinational benchmarks—particularly Toyota’s— remain daunting. Yet, Chattopadhyaya notes that the current buyer cohort is more forgiving. These are consumers who might also choose Volkswagen or Citroën—brands known more for personality than flawless service. Expression, not perfection, is the trade-off.

Maruti and Hyundai: In Transition

According to Ravi Bhatia, President and Director at JATO Dynamics, the rise of Tata and Mahindra does not signal the fall of Maruti and Hyundai—it signals a transition. Maruti and Hyundai still dominate reliability, cost efficiency, service reach, and resale value. Maruti’s 4,500-plus service touchpoints and Hyundai’s strong used-car performance remain formidable strengths.

However, as buyers increasingly ‘trade up', aspiration and emotional differentiation matter more. Tata and Mahindra have adapted faster to this new definition of value. “The real story is not winners versus losers,” Bhatia argues. “It’s about who adapted fastest.”

Beyond 2025: The Road Ahead

The excitement shows no signs of fading. Mahindra began 2026 with 90,000 bookings for the XUV 7XO and XEV 9S, worth ₹20,500 crore. Tata Motors received 70,000 day-one bookings for the Sierra. Cancellations will occur, but the signal is unmistakable: Indian buyers are emotionally invested. India’s SUV market is no longer following global trends—it is defining its own. The true test now lies in sustainability: quality, service, and long-term trust. The race has changed lanes. And for the first time, India’s homegrown brands are setting the pace, not chasing it.