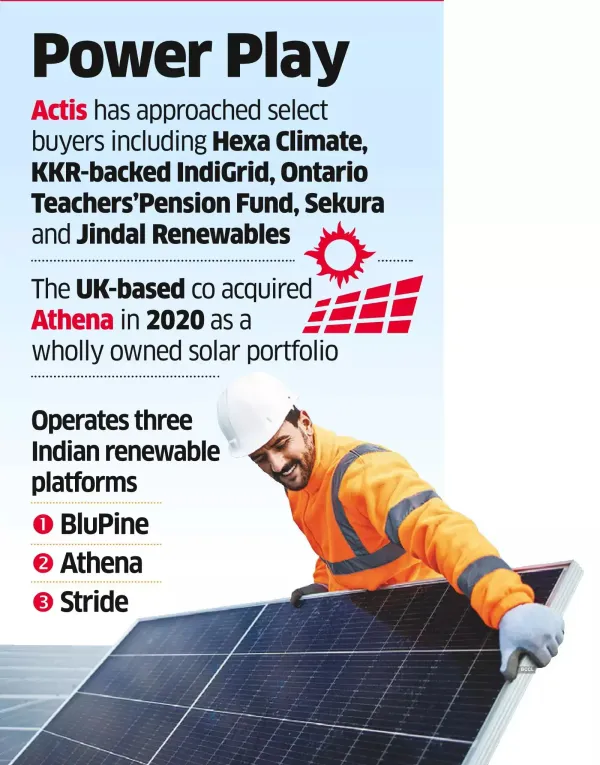

Mumbai: Actis, a UK-based global investor focused on sustainable infrastructure, is looking to exit Athena Renewable Energy, its renewable energy platform in India, said people familiar with the matter. The firm has appointed Kotak Mahindra Capital as its financial adviser for the proposed deal.

The 550 MW solar platform is expected to garner an enterprise value of around ₹3,000 crore, the people said.

Actis has reached out to select potential buyers, including Hexa Climate Solutions, KKR-backed IndiGrid Infrastructure Trust, Ontario Teachers' Pension Fund, Sekura Energy, and Jindal Renewables, the people said.

Actis Long Life Infrastructure Fund acquired Athena in 2020 as a wholly owned solar portfolio comprising two large projects-Rewa and SECI Andhra Pradesh. The platform sells its entire output through 25-year power purchase pacts with state-owned entities and distribution companies as off takers that have central government equivalent credit, according to the Actis website.

Athena operates four solar power plants across India with a total installed capacity exceeding 550 MW. These include the 336 MW Athena Jaipur Solar Plant in Rewa, Madhya Pradesh; the 72 MW Athena Karnal Solar Power Plant; the 72 MW Athena Bhiwadi Solar Plant; and the 72 MW Athena Hisar Solar Power Plant located at the Ananthapuramu Ultra Mega Solar Park in Andhra Pradesh.

Actis didn't respond to email queries.

In India, the firm currently operates three renewable energy platforms-BluPine Energy, Athena Renewables, and Stride Climate Investments, the latter of which was acquired from Macquarie Asset Management in 2024. Prior to launching these platforms, Actis played a key role in building India's clean energy ecosystem through earlier ventures. These include Ostro Energy, founded in 2014, which scaled to over 1.1 GW before being sold to ReNew Power in 2018, and Sprng Energy, established in 2017, which built a portfolio of more than 2 GW and was acquired by Shell for around $1.55 billion in 2022.

Since inception, Actis has deployed more than $7.1 billion across Asia through multiple strategies. As a leading energy investor, it has built or operated more than 8 GW of installed capacity in the region, including more than 5.5 GW of renewable assets.

India's renewable energy deal-making landscape has expanded rapidly in recent years, with corporates, infrastructure funds, and state-owned entities increasingly acquiring operating assets as well as development-stage platforms.

The 550 MW solar platform is expected to garner an enterprise value of around ₹3,000 crore, the people said.

Actis has reached out to select potential buyers, including Hexa Climate Solutions, KKR-backed IndiGrid Infrastructure Trust, Ontario Teachers' Pension Fund, Sekura Energy, and Jindal Renewables, the people said.

Actis Long Life Infrastructure Fund acquired Athena in 2020 as a wholly owned solar portfolio comprising two large projects-Rewa and SECI Andhra Pradesh. The platform sells its entire output through 25-year power purchase pacts with state-owned entities and distribution companies as off takers that have central government equivalent credit, according to the Actis website.

Athena operates four solar power plants across India with a total installed capacity exceeding 550 MW. These include the 336 MW Athena Jaipur Solar Plant in Rewa, Madhya Pradesh; the 72 MW Athena Karnal Solar Power Plant; the 72 MW Athena Bhiwadi Solar Plant; and the 72 MW Athena Hisar Solar Power Plant located at the Ananthapuramu Ultra Mega Solar Park in Andhra Pradesh.

The 550 MW solar energy platform could command a valuation of around ₹3,000 cr

Actis didn't respond to email queries.

In India, the firm currently operates three renewable energy platforms-BluPine Energy, Athena Renewables, and Stride Climate Investments, the latter of which was acquired from Macquarie Asset Management in 2024. Prior to launching these platforms, Actis played a key role in building India's clean energy ecosystem through earlier ventures. These include Ostro Energy, founded in 2014, which scaled to over 1.1 GW before being sold to ReNew Power in 2018, and Sprng Energy, established in 2017, which built a portfolio of more than 2 GW and was acquired by Shell for around $1.55 billion in 2022.

Since inception, Actis has deployed more than $7.1 billion across Asia through multiple strategies. As a leading energy investor, it has built or operated more than 8 GW of installed capacity in the region, including more than 5.5 GW of renewable assets.

India's renewable energy deal-making landscape has expanded rapidly in recent years, with corporates, infrastructure funds, and state-owned entities increasingly acquiring operating assets as well as development-stage platforms.