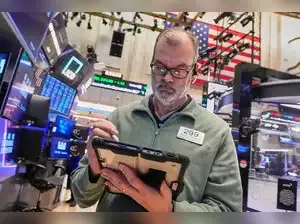

U.S. stock markets open a critical week with elevated risk and strong signals. Dow, S&P 500, and Nasdaq futures are steady ahead of major earnings and a Federal Reserve decision. On Tuesday morning, U.S. stock futures remained largely flat, with the S&P 500 and Dow Jones Industrial Average hovering near break-even, while the Nasdaq-100 slipped 0.2% in premarket trading. This cautious sentiment follows two weeks of market declines fueled by President Donald Trump’s aggressive trade rhetoric and geopolitical maneuvers, including renewed efforts to acquire Greenland.

The defining story of the morning, however, is the historic ascent of gold, which shattered the psychological $5,000 per ounce barrier for the first time in history. Futures for the precious metal climbed more than 2% to reach $5,108 before settling near $5,080, reflecting a massive flight to safety.

Compounding the market jitters is a looming Federal Reserve meeting on Wednesday, where the central bank is widely expected to pause interest rate cuts. Meanwhile, the domestic landscape is reeling from "Winter Storm Fern," a massive system that forced over 20,000 flight cancellations across the East Coast from Saturday through Monday.

Amid this volatility, the tech sector is bracing for "Magnificent Seven" earnings from giants like Microsoft, Meta, and Tesla. While the broader market wavers, specialized sectors are seeing explosive moves: USA Rare Earth (USAR) shares soared over 20% following a landmark $1.6 billion federal funding announcement under the CHIPS Act.

The Federal Reserve’s upcoming interest-rate decision is equally central. While markets broadly expect policymakers to keep rates unchanged, traders will scrutinize the Fed’s statement and press conference for clues on the timing of potential rate cuts later this year. Any shift in tone could move markets sharply, especially after inflation data showed mixed progress toward the Fed’s target.

Recent market momentum has cooled. After repeatedly hitting record highs earlier this month, major indexes have lost ground amid rising geopolitical tension. Investor sentiment has been rattled by renewed trade threats, uncertainty around U.S. foreign policy ambitions, and concern that restrictive financial conditions may persist longer than expected.

Bond markets reflect that caution. The decline in the 10-year Treasury yield suggests increased demand for safe assets, even as equity investors remain selective. Cryptocurrencies were mixed, with Bitcoin trading below recent highs after a volatile weekend. Overall, markets appear to be in a wait-and-see mode, prioritizing risk management over aggressive positioning.

Several forces are driving the rally. Escalating trade tensions, concerns about fiscal sustainability, and uncertainty surrounding global alliances have all pushed investors toward hard assets. Recent threats of new tariffs on Canada, combined with worries about a potential U.S. government shutdown, have added to the sense of instability.

Central bank buying has also played a major role. Global reserve managers have steadily increased gold holdings as they diversify away from traditional currency exposure. This structural demand has tightened supply and amplified price moves during periods of market stress.

Silver has followed gold higher, reaching record levels of its own as industrial demand intersects with investment flows. Analysts remain divided on what comes next. Some see the potential for gold prices to approach $6,000 if geopolitical risks intensify or financial conditions deteriorate further. Others argue that prices could stabilize or retreat later in the year if tensions ease and economic growth improves. For now, gold’s breakout reflects deep-seated caution across global markets.

FlightAware data indicates that over 11,400 flights were canceled on Sunday alone, with LaGuardia Airport in New York and Philadelphia International seeing nearly 90% of their schedules scrapped.

The economic impact is estimated to exceed $300 million due to lost productivity and supply chain bottlenecks. While airlines have implemented proactive schedule thinning to prevent a total network meltdown, the "ripple effect" of displaced crews and aircraft is expected to persist through the end of the week. This logistical chaos is weighing on airline stocks and could impact upcoming quarterly reports for the transportation sector.

As frigid Arctic temperatures linger, the National Weather Service warns that recovery efforts may be hampered by icing, further complicating the return to normalcy for millions of travelers.

A significant shadow has been cast over North American trade as President Trump threatened to impose 100% tariffs on all imports from Canada. The warning follows a controversial trade agreement between Canadian Prime Minister Mark Carney and Beijing, which Trump characterized as making Canada a "Drop Off Port" for Chinese goods entering the U.S. market.

The Canadian-Chinese deal includes provisions for importing up to 49,000 Chinese electric vehicles (EVs) at a reduced tariff rate of 6.1%, a move Trump claims undermines American manufacturing.

In response, Prime Minister Carney defended the deal on Sunday, asserting that it complies with existing USMCA frameworks and is necessary for Canada's economic diversification. However, the escalating "war of words" has heightened fears of a full-scale trade war. This friction coincides with Trump’s continued pressure on Canada over its opposition to the "Golden Dome" missile defense project in Greenland.

Investors are closely monitoring these developments, as a 100% tariff would disrupt essential supply chains in the automotive, energy, and lumber sectors, potentially driving inflation higher and forcing the Federal Reserve to maintain its hawkish stance longer than anticipated.

In a bright spot for the domestic industrial sector, USA Rare Earth (USAR) witnessed a massive premarket rally after securing a transformational $3.1 billion funding package. The deal includes a $1.6 billion commitment from the U.S. Department of Commerce under the CHIPS Act, consisting of $277 million in direct grants and a $1.3 billion senior secured loan.

To solidify the partnership, the U.S. government is expected to take a roughly 10% equity stake in the company, mirroring recent federal investments in Intel.

This capital injection is aimed at accelerating the development of the Round Top mine in Texas and the magnet production facility in Stillwater, Oklahoma. The goal is to establish a resilient domestic supply chain for critical heavy rare earth elements like dysprosium and terbium, which are essential for semiconductor manufacturing and defense technologies.

Currently, these materials are almost exclusively sourced from China. By bringing commercial production forward to 2028, USAR is positioning itself as a cornerstone of U.S. national security and energy independence, driving intense investor interest as the stock eyes new highs.

The defining story of the morning, however, is the historic ascent of gold, which shattered the psychological $5,000 per ounce barrier for the first time in history. Futures for the precious metal climbed more than 2% to reach $5,108 before settling near $5,080, reflecting a massive flight to safety.

Compounding the market jitters is a looming Federal Reserve meeting on Wednesday, where the central bank is widely expected to pause interest rate cuts. Meanwhile, the domestic landscape is reeling from "Winter Storm Fern," a massive system that forced over 20,000 flight cancellations across the East Coast from Saturday through Monday.

Amid this volatility, the tech sector is bracing for "Magnificent Seven" earnings from giants like Microsoft, Meta, and Tesla. While the broader market wavers, specialized sectors are seeing explosive moves: USA Rare Earth (USAR) shares soared over 20% following a landmark $1.6 billion federal funding announcement under the CHIPS Act.

Stock Futures Hold Steady as Earnings and the Fed Take Center Stage

U.S. stock futures pointed to a muted open as investors await key signals from both corporate earnings and monetary policy. Several major technology companies are set to report results this week, with markets looking for confirmation that earnings growth can justify elevated valuations after last year’s rally.The Federal Reserve’s upcoming interest-rate decision is equally central. While markets broadly expect policymakers to keep rates unchanged, traders will scrutinize the Fed’s statement and press conference for clues on the timing of potential rate cuts later this year. Any shift in tone could move markets sharply, especially after inflation data showed mixed progress toward the Fed’s target.

Recent market momentum has cooled. After repeatedly hitting record highs earlier this month, major indexes have lost ground amid rising geopolitical tension. Investor sentiment has been rattled by renewed trade threats, uncertainty around U.S. foreign policy ambitions, and concern that restrictive financial conditions may persist longer than expected.

Bond markets reflect that caution. The decline in the 10-year Treasury yield suggests increased demand for safe assets, even as equity investors remain selective. Cryptocurrencies were mixed, with Bitcoin trading below recent highs after a volatile weekend. Overall, markets appear to be in a wait-and-see mode, prioritizing risk management over aggressive positioning.

Gold Breaks $5,000 as Investors Rush to Safety Amid Global Uncertainty

Gold’s surge past $5,000 per ounce marks a defining moment for global markets. The move reflects an extraordinary demand for safe-haven assets as investors respond to mounting geopolitical and economic risks. Gold futures briefly touched above $5,100 before easing slightly, but prices remain near record territory.Several forces are driving the rally. Escalating trade tensions, concerns about fiscal sustainability, and uncertainty surrounding global alliances have all pushed investors toward hard assets. Recent threats of new tariffs on Canada, combined with worries about a potential U.S. government shutdown, have added to the sense of instability.

Central bank buying has also played a major role. Global reserve managers have steadily increased gold holdings as they diversify away from traditional currency exposure. This structural demand has tightened supply and amplified price moves during periods of market stress.

Silver has followed gold higher, reaching record levels of its own as industrial demand intersects with investment flows. Analysts remain divided on what comes next. Some see the potential for gold prices to approach $6,000 if geopolitical risks intensify or financial conditions deteriorate further. Others argue that prices could stabilize or retreat later in the year if tensions ease and economic growth improves. For now, gold’s breakout reflects deep-seated caution across global markets.

Weather Disruptions, Trade Tensions, and Rare Earth Funding Shape Market Movers

The U.S. travel and logistics industry is struggling to recover from Winter Storm Fern, which blanketed the Northeast with over 12 inches of snow and triggered states of emergency in 21 states. The storm’s timing could not be worse for the airline industry, with major carriers like Delta (DAL), United (UAL), and American Airlines (AAL) reporting widespread disruptions.FlightAware data indicates that over 11,400 flights were canceled on Sunday alone, with LaGuardia Airport in New York and Philadelphia International seeing nearly 90% of their schedules scrapped.

The economic impact is estimated to exceed $300 million due to lost productivity and supply chain bottlenecks. While airlines have implemented proactive schedule thinning to prevent a total network meltdown, the "ripple effect" of displaced crews and aircraft is expected to persist through the end of the week. This logistical chaos is weighing on airline stocks and could impact upcoming quarterly reports for the transportation sector.

As frigid Arctic temperatures linger, the National Weather Service warns that recovery efforts may be hampered by icing, further complicating the return to normalcy for millions of travelers.

A significant shadow has been cast over North American trade as President Trump threatened to impose 100% tariffs on all imports from Canada. The warning follows a controversial trade agreement between Canadian Prime Minister Mark Carney and Beijing, which Trump characterized as making Canada a "Drop Off Port" for Chinese goods entering the U.S. market.

The Canadian-Chinese deal includes provisions for importing up to 49,000 Chinese electric vehicles (EVs) at a reduced tariff rate of 6.1%, a move Trump claims undermines American manufacturing.

In response, Prime Minister Carney defended the deal on Sunday, asserting that it complies with existing USMCA frameworks and is necessary for Canada's economic diversification. However, the escalating "war of words" has heightened fears of a full-scale trade war. This friction coincides with Trump’s continued pressure on Canada over its opposition to the "Golden Dome" missile defense project in Greenland.

Investors are closely monitoring these developments, as a 100% tariff would disrupt essential supply chains in the automotive, energy, and lumber sectors, potentially driving inflation higher and forcing the Federal Reserve to maintain its hawkish stance longer than anticipated.

In a bright spot for the domestic industrial sector, USA Rare Earth (USAR) witnessed a massive premarket rally after securing a transformational $3.1 billion funding package. The deal includes a $1.6 billion commitment from the U.S. Department of Commerce under the CHIPS Act, consisting of $277 million in direct grants and a $1.3 billion senior secured loan.

To solidify the partnership, the U.S. government is expected to take a roughly 10% equity stake in the company, mirroring recent federal investments in Intel.

This capital injection is aimed at accelerating the development of the Round Top mine in Texas and the magnet production facility in Stillwater, Oklahoma. The goal is to establish a resilient domestic supply chain for critical heavy rare earth elements like dysprosium and terbium, which are essential for semiconductor manufacturing and defense technologies.

Currently, these materials are almost exclusively sourced from China. By bringing commercial production forward to 2028, USAR is positioning itself as a cornerstone of U.S. national security and energy independence, driving intense investor interest as the stock eyes new highs.