Like a siren in the dark, a single message is enough to jolt fear—and drain a bank account.

A Familiar Trap, Now on a Wider Net

In late 2025, when Bengaluru Police announced a 50 per cent discount on traffic penalties, cybercriminals exploited the moment by circulating fake traffic fine messages to unsuspecting smartphone users. That scam is now back—broader, sharper, and aimed at victims across multiple cities and towns in India.

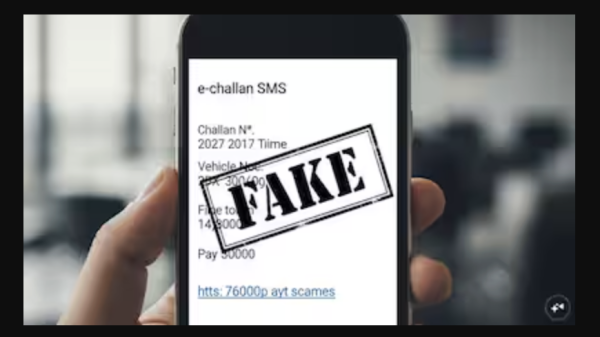

The latest version mimics official e-challan alerts. Fraudsters send messages via WhatsApp and other messenger apps claiming the recipient has violated traffic rules. The messages warn that failure to pay immediately will result in authorities visiting homes and seizing vehicles. Panic is the hook.

Each message carries a URL that redirects users to a convincing-looking website resembling an official government portal. The page displays the State Emblem of India—an adaptation of the Lion Capital of Ashoka—and claims to be managed by the Union Ministry of Road and Transport. Victims are prompted to enter debit or credit card details, including CVV numbers and expiry dates. Once submitted, the scamsters siphon money from linked bank accounts within minutes.

Spot the Red Flags, Stay One Step Ahead

Cybersecurity experts urge citizens not to panic or act impulsively. Any suspicious traffic fine message should be verified directly at a nearby traffic police station or through official portals. Government agencies do not demand personal or financial details through messaging apps.

Users are advised to avoid clicking unknown links or downloading attachments, even if the sender appears to be a known authority. Installing apps from third-party sources or APK files promoted on social media is another major risk. Traffic fines in Bengaluru, for instance, can be safely paid only through official websites like or or via authorised apps such as BTP ASTraM and KarnatakaOne.

Sharing sensitive details—bank credentials, passwords, Gmail IDs—or entering such information on unfamiliar websites should never be done. Keeping devices updated with the latest software and installing reputable antivirus applications with safe browsing enabled can significantly reduce exposure to cyber threats.

If someone falls victim to such fraud, immediate action is crucial. Calling the toll-free helpline 1930 within an hour can help authorities trace transactions and freeze mule bank accounts before the money disappears.

In a world of digital shortcuts, caution remains the strongest firewall.

Summary

Cybercriminals have revived a fake e-challan scam, sending threatening messages about traffic fines to users across India. The scam uses lookalike government portals to steal card details and drain bank accounts. Authorities advise verifying fines through official channels, avoiding suspicious links, and reporting fraud immediately via helpline 1930.

-

Steps initiated to revive BRIMS, says Minister Sharan Prakash Patil

-

Helicopter survey for gold begins around Gudibande, land price speculation grows

-

Independent pubs need to sell 825 million more pints to cover Rachel Reeves's rates hike

-

Sonu Sood calls for nationwide social media ban for children under 16

-

Rajasthan: ISI spy arrested in Pokharan sent on a 5-day remand