Petrol drivers are facing 16p-per-mile charges in January. According to the latest RAC figures for petrol, the average price per litre is currently 131.9p for unleaded and 140.7p for diesel at forecourts across the UK.

By the start of February, the price of petrol had dropped to by 3p in the past month, while diesel has come down in price by the same amount.

According to motoring and insurance website Nimblefins, the average fuel economy of UK petrol cars is 36mpg, which means that, based on the current price per litre, it currently costs 16.54p per mile to run a petrol car, not including any other costs such as maintenance.

In recent months, the government also announced a new pay-per-mile tax, specifically for electric cars.

Chancellor Rachel Reeves unveiled the policy to introduce a 3p-per-mile tax for EVs which is set to take effect from 2028.

When coupled with the average cost of charging an EV at home, this would bring the cost of running an electric car to between 5p and 11p per mile.

The scheme is set to be implemented in 2028 following a consultation, and would cost EV drivers an average of £250 per year.

Motoring groups expressed concerns that such a tax could put some people off from switching to electric cars.

The Treasury faces a reduction in revenue from fuel duty as more drivers move from petrol or diesel cars to EVs.

Successive governments have found the prospect of introducing per-mile charges for driving - sometimes referred to as road pricing - too politically toxic.

Ms Reeves's EV scheme will involve users estimating how far they will drive over the following 12 months, and making an extra payment on top of vehicle excise duty (VED).

If they drive more they will need to top up this amount, while some of the money would carry over to the next year if someone clocks up fewer miles.

Journey examples at 3p per mile include £12 from London to Edinburgh, £5 between Cambridge and Bristol, and £2 between Liverpool and Leeds.

EVs' exemption from road tax, officially called VED, was removed in April 2025.

A Government spokesperson said: "Fuel duty covers petrol and diesel, but there's no equivalent for electric vehicles.

"We want a fairer system for all drivers whilst backing the transition to electric vehicles, which is why we have invested £4 billion in support, including grants to cut upfront costs by up to £3,750 per eligible vehicle.

"Just as it is right to seek a tax system that fairly funds roads, infrastructure and public services, we will look at further support measures to make owning electric vehicles more convenient and more affordable."

-

Are you worried about high uric acid? These 4 fruits rich in Vitamin C will give instant relief!

-

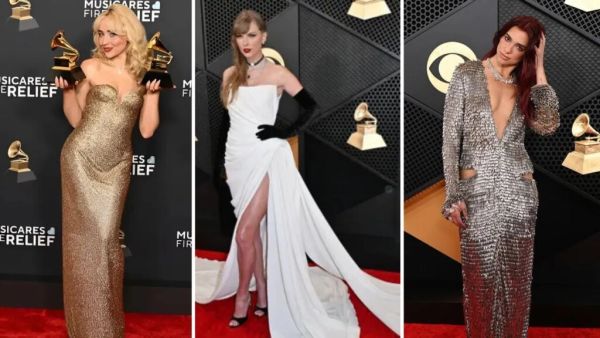

Grammy fashion moments that changed red carpet dressing forever

-

Golden opportunity for writers in xAI

-

Transit of enemy planet in the house of Venus, auspicious sign for these 3 zodiac signs, there may be increase in wealth and prosperity.

-

Smartphones to be launched in February 2026: Complete list from flagship to powerful mid-range