Credit Card Interest Calculation: In today's world, the use of credit cards has increased significantly. Using them is also very easy – just a swipe and the payment is done. Most people, while enjoying this convenient feature, forget that they will have to repay this money later. Behind this convenience lies a complex web of interest calculations, which, if you understand it, might make you think twice before using your card again.

The interest charged on credit cards is called a complex web because its calculation is very different from regular interest. However, it is only applied when you forget to make a payment or intentionally don't pay. As a result, you are charged a penalty along with interest on your outstanding balance. Even if you pay the minimum due amount, you will still be charged a hefty interest. Let's understand the calculation of interest on credit cards.

First, understand the 'Interest-Free Period.'

Whenever a bank or agent sells a credit card, they tell customers that they will get a 45-50 day interest-free period. This means that you will not have to pay any interest on the amount you spend using the card for 45-50 days. However, you must pay your bill on time; otherwise, the interest charged will be very high.

Now, understand the formula for calculating interest

Banks use the Average Daily Balance (ADB) method to calculate interest. The formula is as follows:

Interest = (Outstanding Amount × Number of Days × Monthly Interest Rate × 12) / 365

Here, the 'number of days' is counted from the day you made the purchase, not from the day your bill was generated.

Let's understand with an example.

Under the 50-day interest-free period, a transaction made on January 1st will not incur any interest until February 20th (which will be the due date for paying the bill). If you paid the bill on February 21st, interest will not be charged for just one day on that transaction, but for 51 days. Similarly, interest will be calculated on transactions made on different days based on how many days ago they were made.

Let's say your card's monthly interest rate is 3.5%. Now let's see how the calculation works.

January 1st: You purchased goods worth ₹10,000.

January 20th: Your bill was generated.

February 20th: Your bill's due date (with a 50-day interest-free period).

February 21st: You did not pay the bill on February 20th and paid it on February 21st.

Now, interest will be charged not for 1 day, but for 51 days, because this transaction was made on January 1st. Although some banks offer a 1-2 day grace period after the due date, most banks do not.

Now let's put this into the formula...

Interest = (Outstanding amount × Number of days × Monthly interest rate × 12) / 365

Interest = (10,000 × 51 × 3.5% × 12) / 365 = ₹586

This means that if you delay paying your bill by even one day, you will have to pay approximately ₹586 in interest on a ₹10,000 transaction.

3.5% monthly interest does not mean 42% annually... Absolutely not!

When it comes to credit card interest calculation, it's important to understand that it's calculated every month. This means that if the bank is charging 3.5% monthly interest on your outstanding balance, it doesn't amount to 42% annually, but rather 51%. So, on the ₹10,000 transaction made on January 1st, the interest alone would be ₹5100 after a year.

In addition, there will be a separate GST charge of ₹918. Not only that, but every month you fail to pay your bill, a late fee will be added, and because these late fees accumulate, interest will also be charged on them. This means that if you don't make any payments for the entire year, a Rs. 10,000 outstanding balance, along with penalties, interest, and GST, could easily balloon to Rs. 7,000-8,000 or even more.

Understanding the 'Minimum Amount Due' Trap

When you only pay the 'Minimum Amount Due', don't assume you've escaped hefty interest charges. In reality, you've only avoided the late payment penalty and prevented your card from being blocked for future transactions. You can continue using your card for another month without paying the full bill, but this strategy will cost you dearly.

Let's say you purchased Rs. 10,000 on January 1st, and the bill was due on February 20th. Your bill came to Rs. 10,000, with a minimum amount due of Rs. 500. If you pay that Rs. 500, you won't incur a late payment penalty, nor will your card be blocked. However, when you pay the bill again the following month, on March 20th, your outstanding balance of Rs. 9,500 will have increased to Rs. 10,375 due to a 3.5% monthly interest charge (a total of Rs. 875).

Disclaimer: This content has been sourced and edited from NDTV India. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.

-

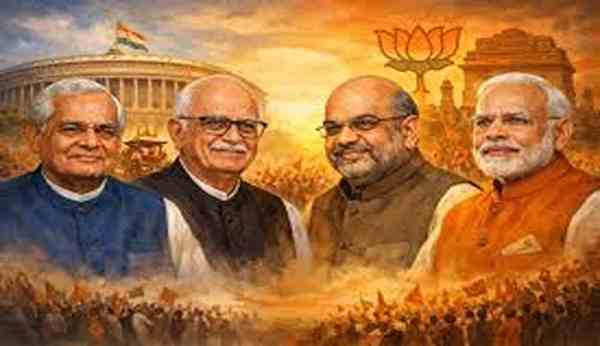

Indian Politics: A New Generation of Leadership Takes Shape

-

Nepal: Sher Bahadur Deuba’s Exit from Electoral Politics Signals a Turning Point in Power Structure

-

Tamil Nadu: Constitutional Dispute in Assembly Highlights Debate on Governor’s Role

-

A colour, which became a brand… What is the story of the fashion world’s most iconic color ‘Valentino Red’?

-

A colour, which became a brand… What is the story of the fashion world’s most iconic color ‘Valentino Red’?