Millions of pensioners could be forced to fill out self-assessment tax returns after the triple lock pushes the state pension over the personal income allowance. Commentators sounded the alarm after it emerged that the state pension would rise to £12,548 per year next April, just £22 short of the threshold at which people have to start paying income tax. The triple lock - which pushes the state pension up each year in line with whichever is highest of total earnings growth, Consumer Prices Index (CPI) inflation or 2.5% - could put millions of retirees in the tax bracket by 2027, it has been estimated.

HMRC has not specified how pensioners would have to pay the tax after crossing the threshold, which has been frozen at £12,570 until at least 2028, but it could be through a digital self-assessment tax return. Dennis Reed, of the over-60s charity Silver Voices, said the change would impose an "administrative burden" on "vulnerable" retirees who aren't digitally savvy.

"I'm concerned about the administrative burden that could be pushed on to vulnerable pensioners who will be left worrying about their tax liability and anxious about filling out online assessment forms if they're not online themselves," Mr Reed told The Times.

"Older people in particular do not like to be in debt. It's not a way they're used to living."

While the former Conservative Government planned to hike the personal allowance for pensioners by 2.5% to dodge imposing a "retirement tax", Labour is reportedly considering lowering income tax thresholds further in a bid to boost public funds.

Almost 13 million people receive the full state pension in the UK and commentators including the Low Incomes Tax Reform Group (LITRG) and Sir Steve Webb, former pensions minister and partner at the consultancy LCP, have suggested that many will be in the income tax bracket by 2027.

"It is already the case that nearby three quarters of all pensioners pay income tax, and the ongoing freeze in tax thresholds coupled with steady rises in the pension will drag more and more into the tax net," Sir Steve told the BBC.

The Low Incomes Tax Reform Group has urged the government to introduce a dedicated Pay As You Earn (PAYE) system for pensioners, making it easier for them to pay the tax they owe, although analysis published in 2013 by the former Office for Tax Simplication estimated that such a move would cost £100 million.

Sarah Weston, technical officer for the LITRG, said retirees could "end up with a nasty shock" if they receive an unexpected tax bill from HMRC at the end of the tax year, with many likely to find the sudden change "unclear and confusing".

A spokesperson for HMRC said: "No one has to file a tax return because the amount they get in state pension takes them over the personal allowance. Existing self assessment customers pay any additional tax owed on the old state pension through self assessment. Those taxpayers who are employed or get a private pension usually have this tax collected via PAYE, while anyone else affected may be issued a simple assessment."

-

An e-passport system is about to be implemented in the country. Will old passports be invalidated?

-

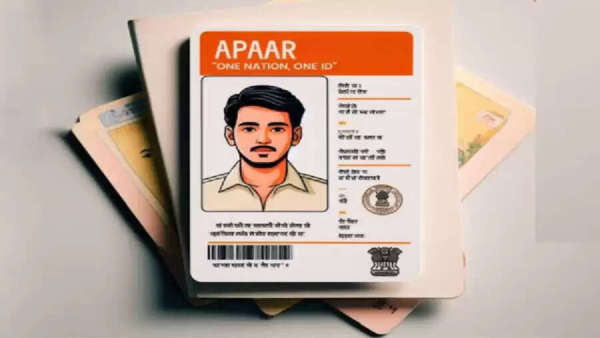

So many lakh Anganwadi children will receive the Apaar Card, learn about its benefits.

-

In response for complaints of electricity theft, the government has created a unique app.

-

How can you withdraw your money from dead bank accounts? Learn about this important information.

-

Who has the higher rank between the ADM and SDM? Find out who holds what power?